According to the National Restaurant Association, majority of restaurants in the U.S. have implemented a service charge in some form to offset rising operational costs. These charges have sparked debate among diners, restaurant workers, and owners alike. While some believe it simplifies tipping culture, others argue it creates confusion.

A service charge at a restaurant is a pre-determined fee added to the bill. Unlike voluntary tips, service charges are mandatory and often distributed among employees or, in some cases, retained by the business. This practice, commonly referred to as “automatic gratuities,” is often misunderstood. Many diners mistakenly assume that automatic gratuities are tips meant for the service staff, but these charges are usually kept by the employer. With varying state laws, it’s essential to understand the ins and outs of service charges, as well as what they mean for diners, restaurant workers, and business owners.

What is a Service Charge at a Restaurant?

A service charge in a restaurant is a fixed percentage added to the customer’s bill to cover various service-related costs. This charge is typically predetermined by the establishment and automatically included in the final bill.

Unlike voluntary tips, a service charge is often mandatory and intended to ensure a steady income for staff, contributing to their wages and benefits. It aims to simplify the payment process and create a more equitable distribution of earnings among restaurant employees. This fee helps stabilize revenue distribution, especially in locales where tipping is less common or during times when business is slow, providing financial security for the staff.

How a Service Charge Differs from a Tip or Gratuity

While both service charges and tips aim to compensate restaurant staff for their service, there are distinct differences between the two:

- Mandatory vs. Voluntary: A service charge is typically mandatory and automatically added to your bill. In contrast, a tip is a voluntary amount that customers can choose to give based on their satisfaction with the service.

- Distribution: Service charges are collected by the establishment and then distributed to employees according to a pre-set formula, which may not always be transparent to customers. Tips are generally given directly to the service staff or pooled among the staff present during the shift.

- Purpose: A service charge is designed to cover the operational costs of the restaurant, including wages for all employees. Tips, however, are intended to reward staff for their individual service performance.

- Taxation: Service charges may be subject to tax regulations different from tips, depending on local tax laws. The Internal Revenue Service (IRS) treats service charges as mandatory payments, categorizing them as business income, whereas tips are considered personal income for employees.

- Employee Dependence: In some regions, employees rely more on tips for a substantial part of their earnings. Service charges provide a more predictable income but might not always reflect the level of service provided.

- Customer Perception: Customers may view service charges as less personal than tips, which are directly linked to their dining experience and satisfaction with the service.

- Transparency: Restaurants are generally required to disclose if a service charge will apply and its rate, which is not the case with tips that can be given at the customer’s discretion.

Understanding these distinctions helps diners navigate their obligations and expectations when paying at a restaurant, ensuring they appreciate where their money is going and how it benefits the staff.

How is a Service Charge Calculated?

A mandatory service charge is calculated as a fixed percentage of the total bill at a restaurant. This percentage is set by the restaurant and is usually clearly stated on the menu or informed by the staff before you order. The typical range for a service charge is between 10% and 20%. This charge is meant to be distributed among the staff to supplement their wages and ensure that all employees receive fair compensation for their work.

For example, if you dine at a restaurant where the service charge is set at 15% and your meal costs $100, an additional $15 will automatically be added to your bill as a service charge. So, the total amount you would pay is $115. This mandatory service charge is then used by the restaurant to contribute to the salaries of the workers, helping to stabilize their income regardless of the restaurant’s traffic or individual tipping habits.

Service Charge vs. Tip: What’s the Difference?

A clear understanding of the differences between service charges and tips can prevent confusion for both customers and restaurant owners. Below is a side-by-side comparison:

| Factor | Service Charge | Tip |

|---|---|---|

| Mandatory? | Yes | No |

| Percentage? | Fixed by the restaurant (usually 15-20%) | Determined by the customer |

| Goes to staff? | Sometimes distributed, sometimes kept by the employer | Directly to the server |

| Taxable? | Subject to sales tax | Not subject to sales tax |

| IRS Treatment? | Considered revenue, not tip income | Considered tip income |

Service charges are classified as business income, whereas tips are legally recognized as tip income paid directly to employees. This distinction affects tax reporting, payroll processing, and employee compensation.

To stay compliant, businesses must communicate service charges clearly to avoid legal issues. If an employer violates local ordinances, they may face fines, lawsuits, or reputational damage.

Are Service Charges Beneficial for Restaurant Workers?

The impact of service charges on restaurant workers is a topic of considerable debate. Some workers welcome the predictable income that service charges provide, while others feel it diminishes the incentive to deliver excellent service.

Pros for Restaurant Workers:

- Predictable Income

Unlike tips, which can fluctuate based on customer satisfaction, service charges offer workers a more predictable income. This stability is especially beneficial during slow shifts or in regions where tipping is less common. - Earnings for All Staff

Service charges can be distributed among all restaurant staff, including those who typically do not receive tips, such as cooks and dishwashers. This reduces wage disparity and ensures that everyone contributes to the restaurant’s success. - Less Wage Disparity

Service charges help reduce the wage gap between employees, ensuring that even during slow periods, all workers are compensated fairly.

Cons for Restaurant Workers:

- Less Incentive to Provide Top Service

Without the direct link between tips and service quality, some employees may feel less motivated to go the extra mile for customers. - Potential Employer Abuse

If the employer keeps a portion of the service charge, workers may not benefit as much as they would from direct tips. - Higher Taxes

Since service charges are considered taxable income, employees may face higher taxes, reducing their overall take-home pay compared to untaxed tips.

How Restaurants Can Ensure Transparency About Service Charges

For restaurants, transparency about service charges is crucial for maintaining customer trust and satisfaction. If customers feel confused or misled about where their money is going, it can lead to frustration and negative reviews.

Best Practices for Restaurants:

1. Provide Clear, Consistent Messaging

Clearly communicate service charge policies on menus, websites, and bills. Make sure customers know if a service charge is being added, how much it is, and whether it’s mandatory or optional.

2. Address Common Customer Questions

Customers often ask if service charges go directly to the staff. If the charge is distributed among employees, used for operational costs, or mandated by law, staff should be able to explain this transparently. Any ambiguity can create confusion and dissatisfaction.

3. Use Positive and Customer-Friendly Language

Instead of making it sound like an extra fee, staff should frame service charges as a standard practice that enhances service quality, helps retain skilled employees, or covers rising operational costs. A positive approach reduces friction in customer interactions. Additionally, it is crucial to understand that if a restaurant employer violates local ordinances regarding service fees, they may face civil and criminal penalties.

4. Practice Role-Playing Scenarios

Conduct role-playing exercises where staff respond to different customer reactions—some may accept the charge easily, while others might be upset. Training employees to remain calm, professional, and courteous ensures smoother interactions.

5. Offer Solutions for Dissatisfied Customers

If a customer is unhappy about the charge, staff should know how to escalate the concern to a manager or offer alternative solutions, such as explaining tipping policies or company guidelines.

By preparing your staff with clear, confident communication, you can turn potentially negative experiences into opportunities for educating customers and reinforcing transparency.

6. Make Restaurant Training Seamless with KNOW LMS

A well-trained team is the key to delivering exceptional service and maintaining compliance in the restaurant industry. With KNOW LMS, restaurant owners and managers can streamline training, ensuring staff members are prepared to handle all essential aspects of restaurant operations.

KNOW offers a user-friendly platform with structured learning paths, interactive modules, and real-time progress tracking—all in one place. This makes it easier for your team to grasp important topics, from explaining service charges clearly to adhering to food safety and customer service standards.

Here’s how KNOW LMS helps:

✔️ Onboard new hires quickly with easy-to-follow modules that cover everything from service charges to customer interaction.

✔️ Ensure compliance with labor laws, service charge regulations, and operational standards, helping avoid any potential issues down the road.

✔️ Standardize training across locations so your team delivers consistent service, no matter where they are, and communicates all policies the same way.

✔️ Track staff progress with real-time reports and automated assessments, ensuring that everyone is on the same page about all key practices.

✔️ Make learning fun with engaging, gamified training that helps your team retain crucial information and stay confident when dealing with customers.

No more outdated training manuals or scattered resources. With KNOW, restaurant training becomes easier and more efficient, ensuring your team is always prepared to deliver top-notch service.

Want to see KNOW LMS in action? Book a free demo today!

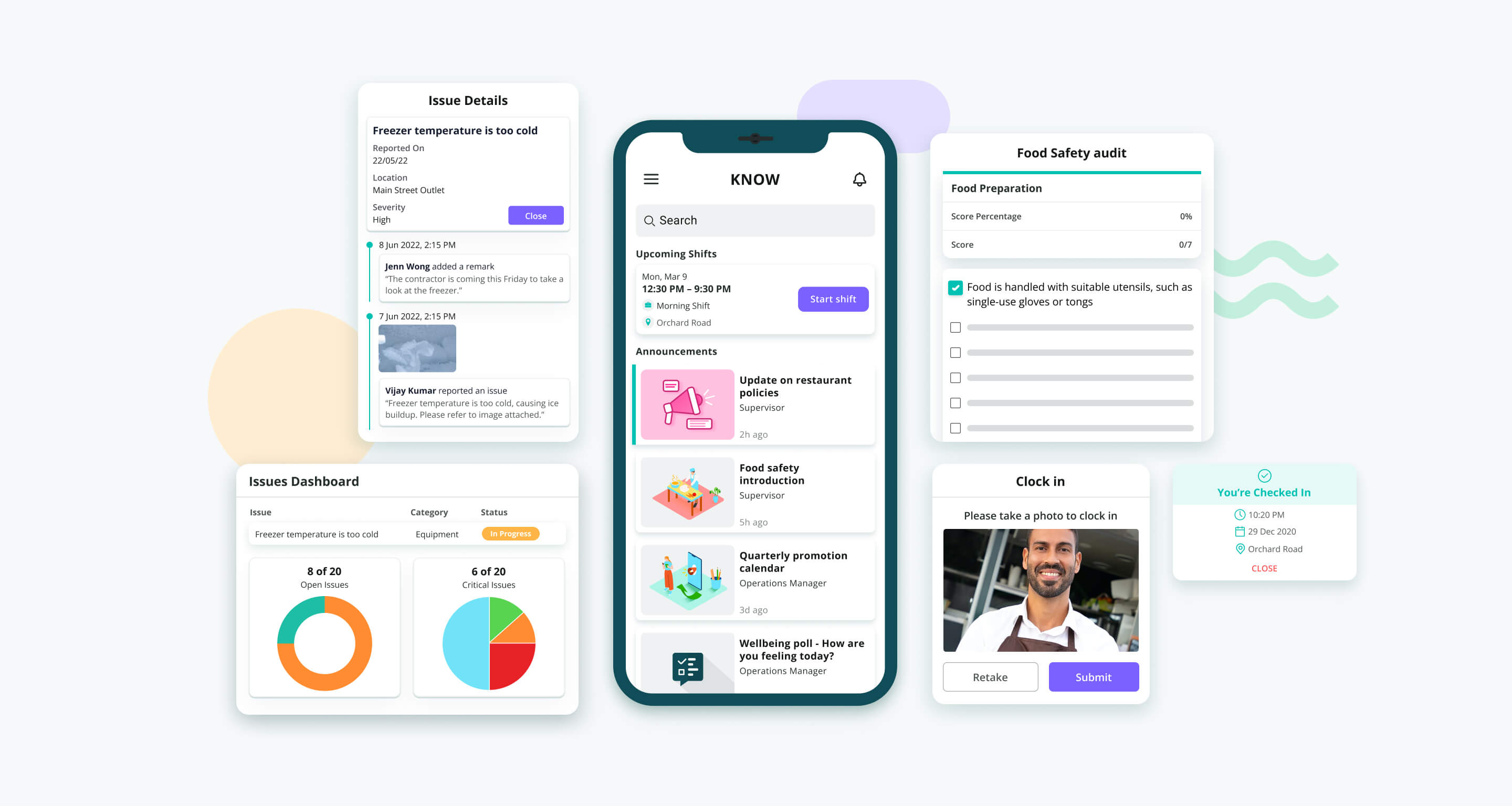

Other features of KNOW that can improve your restaurant operations

KNOW is an all-in-one digital operations assistant designed specifically for the restaurant industry. KNOW is like the Swiss Army knife of restaurant management—it does it all. From task management to employee training, this platform brings everything under one roof, so you can say goodbye to juggling multiple tools.

Key Features

- Task Management: Create and manage customizable checklists for tasks such as kitchen handovers, opening/closing procedures, and sales tracking.

- Food Safety Compliance: Prepare and manage HACCP checks, conduct hygiene audits, and monitor food and equipment temperatures to ensure compliance with health standards.

- Audit Management: Digitize various audits, including pest control and fire safety, allowing for easy scheduling and tracking of compliance status.

- Maintenance & Incident Reporting: Report and track equipment faults or incidents in real time, ensuring swift resolution of issues to minimize downtime.

- Scheduling & Attendance Tracking: Manage full-time and part-time staff schedules efficiently while tracking attendance to reduce errors.

FAQs on Restaurant Service Charges

1. Is a service charge the same as a tip?

No, a service charge is a mandatory fee set by the restaurant, whereas a tip is a voluntary amount given by the customer based on service quality. Service charges are sometimes referred to as automatic gratuities. These automatic gratuities are often retained by the business rather than distributed among the service staff, leading to misconceptions among customers about tipping practices.

2. Can a restaurant keep the service charge instead of giving it to employees?

Yes, depending on state laws, some restaurants may keep part or all of the service charge to cover operational costs. However, transparency is crucial, and many states require restaurants to disclose how service charges are allocated.

3. Why do some restaurants add an automatic gratuity?

Restaurants implement automatic gratuity to provide fair wages for staff, offset rising operational costs, and simplify tipping for customers. It ensures service workers receive predictable pay regardless of tipping variations.

4. Can I refuse to pay a service charge at a restaurant?

In most cases, service charges are mandatory, and customers cannot refuse to pay them unless explicitly stated as optional. However, diners can inquire about policies before dining or discuss concerns with management.

5. How can restaurants ensure transparency about service charges?

Restaurants should clearly state service charge policies on menus, bills, and websites. Proper staff training is essential to explain these charges to customers and avoid misunderstandings or disputes.

![The 10 Best Restaurant Scheduling Software and Apps [2025] restaurant scheduling software](https://www.getknowapp.com/blog/wp-content/uploads/2024/09/restaurant-scheduling-software-360x240.png)