Efficient payroll management is essential for any restaurant, big or small, to keep operations smooth and employees satisfied. However, managing payroll can quickly become overwhelming due to complex processes like calculating tips, tracking hours, and adhering to ever-changing labor laws.

In 2024, with average hourly wages for restaurant workers having risen by 66% since 2017, accurate payroll management has become even more crucial. Adopting a reliable payroll solution not only prevents costly errors but also keeps your team motivated and your restaurant compliant.

In this article, we’ll explore the unique challenges of restaurant payroll—such as tip management and intricate tax withholdings—and see how modern payroll and accounting software solutions can streamline these tasks.

Benefits of Using Payroll Restaurant Software

Restaurant payroll software has several benefits that can dramatically enhance operations. By automating payroll processes including tax deductions, tip management, and wage computation, it saves time and minimizes mistakes. It guarantees accurate payroll processing and adherence to labor regulations by connecting with scheduling and time-tracking systems. Let’s take a closer look at these benefits in detail.

1. Reduced Payroll Errors and Time Savings

- Automated Calculations: Automate complex payroll calculations, including taxes, benefits, and deductions, reducing the risk of human error.

- Batch Processing: Process payroll for multiple employees simultaneously, saving time and effort compared to manual processing.

2. Streamlined Payroll Processing with Automation

- Scheduled Payroll Runs: Set up automatic payroll runs on a regular schedule, ensuring timely payments without manual intervention.

- Direct Deposits: Facilitate direct deposits to employee bank accounts, speeding up the payment process and reducing the need for paper checks.

3. Improved Employee Satisfaction and Transparency

- Self-Service Portals: Provide employees with access to self-service portals where they can view pay stubs, tax forms, and update personal information.

- Transparent Pay Statements: Ensure employees receive clear and detailed pay statements, fostering trust and reducing payroll-related queries.

- Timely Payments: Consistently pay employees on time, enhancing satisfaction and reducing turnover.

4. Enhanced Security and Data Protection

- Secure Data Storage: Protect sensitive payroll data with robust security measures, including encryption and secure access controls.

- Compliance with Data Protection Regulations: Ensure the software complies with data protection regulations, safeguarding employee information.

5. Cost Savings

- Reduced Administrative Costs: Lower administrative costs by automating payroll processes and reducing the need for manual intervention.

- Avoidance of Penalties: Minimize the risk of penalties for non-compliance with labor laws and tax regulations through accurate and timely payroll processing.

By focusing on these key features and benefits of the best restaurant payroll software, restaurants can significantly improve their payroll management processes, ensuring compliance, efficiency, and employee satisfaction.

What are the common challenges for restaurants while introducing a new payroll system?

New payroll software implementation may be a big task. In the absence of meticulous planning and foresight, organizations may face specific challenges that can complicate their operations. Here are the top six common and most popular payroll software challenges faced by restaurants:

1. Incorrect Employee Classification

Misclassifying employees as exempt or non-exempt can result in expensive penalties. In the restaurant and hospitality industry, it’s essential to accurately classify staff as either salaried or hourly workers to ensure proper eligibility for overtime and benefits.

2. Managing Tips and Overtime for Tipped Employees

Employees who receive tips need specific payroll considerations to guarantee compliance with minimum wage laws. Using specialized payroll software can enhance the accuracy of tracking tips and guarantee precise calculations for overtime rates, especially when tips contribute to overall earnings.

3. Compliance with Changing Labor Laws

Labor laws are always changing, and restaurants must keep abreast of updates regarding minimum wage, overtime regulations, and employee health benefits too. Using a payroll software for restaurants can streamline compliance by automatically updating payroll calculations to align with new legal requirements.

4. Accurate Tax Withholding

Depending on the employee’s income, tax withholdings for both government and state income taxes might differ substantially. Payroll software makes this process easier by automating tax calculations and ensuring the correct amounts are withheld, which helps minimize the chances of errors.

5. Maintaining Accurate Records

Restaurants need to maintain accurate records for payroll, tax reporting, and audits. Payroll software keeps this information safe and sound, ensuring it’s readily available for all your financial management, reporting, and compliance needs.

6. Not Taking Overtime Into Consideration

In the restaurant and food service industry alone, tackling overtime calculation presents a significant challenge. Keeping accurate timesheets is a challenge that requires diligence, and ensuring that you’re paying more than the average hourly rate for overtime adds another layer of complexity to the task.

Neglecting this aspect of payroll processing presents a formidable challenge, potentially leading to back pay and financial penalties.

Key Features to Look for in Restaurant Payroll Software

When choosing the right payroll software for your restaurant, prioritize key features to improve operations and maintain compliance. Restaurant payroll software may assist in addressing the unique problems that restaurants have, such as managing tipping employees and several pay rates, as well as monitoring overtime and tax withholdings.

Explore KNOW for a change !

Book a call for a personalized demo!

The best payroll software includes time tracking, schedule integration, tax compliance automation, expandable reporting, and more. Let’s explore these key features:

1. Compliance with Labor Laws and Tax Regulations

- Automatic Updates: The restaurant payroll software should automatically update to reflect changes in federal, state, and local labor laws and tax regulations. This ensures continuous compliance without manual intervention in the hospitality industry.

- Audit Trails: Maintain detailed records of all payroll transactions and changes, which are essential for audits and resolving disputes.

- Customizable Compliance Settings: Adapt to specific regional requirements and unique business needs, ensuring all aspects of payroll are compliant.

2. Multi-Location Support and Scalability

- Centralized Management: Manage payroll for multiple locations from a single platform, simplifying oversight and reducing administrative burden.

- Scalability: The restaurant payroll software should grow with your business, easily accommodating new locations and employees without significant additional costs or complexity.

- Location-Specific Reporting: Generate reports for individual locations to monitor performance and compliance at each site.

3. Integration with Scheduling and Attendance Systems

- Real-Time Data Sync: Integrate seamlessly with scheduling and attendance systems to capture real-time data on employee hours, reducing manual entry and errors.

- Automated Overtime Calculations: Automatically calculate overtime based on integrated attendance data, ensuring accurate and compliant payments.

- Shift Management: Link payroll with shift management to streamline the process of tracking hours worked and managing shift changes.

4. User-Friendly Interface

- Ease of Use: A simple, intuitive interface that requires minimal training for staff to use effectively.

- Mobile Access: This allows restaurant managers and employees in the hospitality industry to access payroll information and perform tasks from mobile devices, enhancing flexibility and convenience.

5. Comprehensive Reporting and Analytics

- Detailed Payroll Reports: Generate comprehensive reports on payroll expenses, tax liabilities, and employee earnings.

- Analytics Tools: Use built-in analytics to identify trends, forecast payroll expenses, and make informed business decisions.

Step-by-Step Process to Choose the Right Payroll Restaurant Software

Let’s delve deeper into the step-by-step process on how to choose the best restaurant payroll software that best fits your restaurant’s unique needs, ensuring efficient restaurant payroll solutions and management.

1. Identify Your Needs:

Determine the size of your restaurant and the number of employees. In addition, you can identify specific features you need, such as tip management, multiple pay rates, and compliance with local labor laws.

2. Research and Compare Options:

Look for restaurant payroll software that offers features tailored to restaurants, such as KNOW platform. You can also compare pricing plans and check for any additional costs per employee.

3. Check Integration Capabilities:

Ensure the software integrates seamlessly with your existing POS systems and other restaurant management tools.

4. Evaluate Ease of Use:

Choose software with a user-friendly interface that simplifies payroll administration & processing and minimizes errors.

5. Consider Compliance Features:

Ensure the software helps you stay compliant with tax regulations and labor laws, including tip reporting and overtime calculations.

6. Read Reviews and Get Feedback:

Look at user reviews and ratings to understand the experiences of other restaurant owners. You can also seek recommendations from peers in the restaurant industry.

7. Take Advantage of Free Trials:

Utilize free trials or demos to test the software and see if it meets your needs before committing.

8. Assess Customer Support:

Ensure the restaurant payroll software provider offers reliable customer support to assist with any issues or questions.

Onboarding and Setting Up Your Payroll Restaurant Software

Step 1: Define Your Payroll Needs and Processes

Begin by detailing your payroll needs and pinpointing any specific requirements, like managing tips, overtime, or shift differentials. Clarifying these details at the beginning allows you to set up the software to align payroll features with the unique requirements of your restaurant.

Step 2: Import Employee Data

Collect important employee details including work hours, tax information, and pay rates. Many restaurant payroll software options enable you to upload data in bulk or connect directly with your own HR management system. This action guarantees that all employee payroll and hr records are accurate and updated that helps manage payroll and tax calculations, right from the start.

Step 3: Configure Payroll Rules

Establish rules for payroll software that comply with local labor laws and meet the specific needs of the restaurant. This involves configuring pay rates for various roles, establishing tip pooling policies, and overseeing deductions and the health benefits together. Automating these processes allows for time savings and minimizes the chances of human error.

Step 4: Train Your Team

Conduct training sessions for managers and payroll staff to guide them in utilizing the benefits administration and new system effectively. Training sessions may consist of detailed instructions on how to do benefits administration, run payroll, submit timesheets, track hours, and update personal information. A skilled team can assist you in enhancing the software’s effectiveness and maintaining precise payroll records.

Step 5: Conduct a Test Run

To ensure everything is functioning correctly, start by conducting a test payroll run before fully implementing your new payroll software. This test run allows you to pinpoint any issues or discrepancies that require attention prior to the first official payroll cycle, helping to avoid potential payroll services errors and compliance problems.

How KNOW App Complements Restaurant Accounting and Payroll Software?

The KNOW platform comes with a range of features that work together to ensure that restaurant payroll processes are accurate and efficient. These features make the payroll process and management smoother and reduce administrative overhead for restaurant owners.

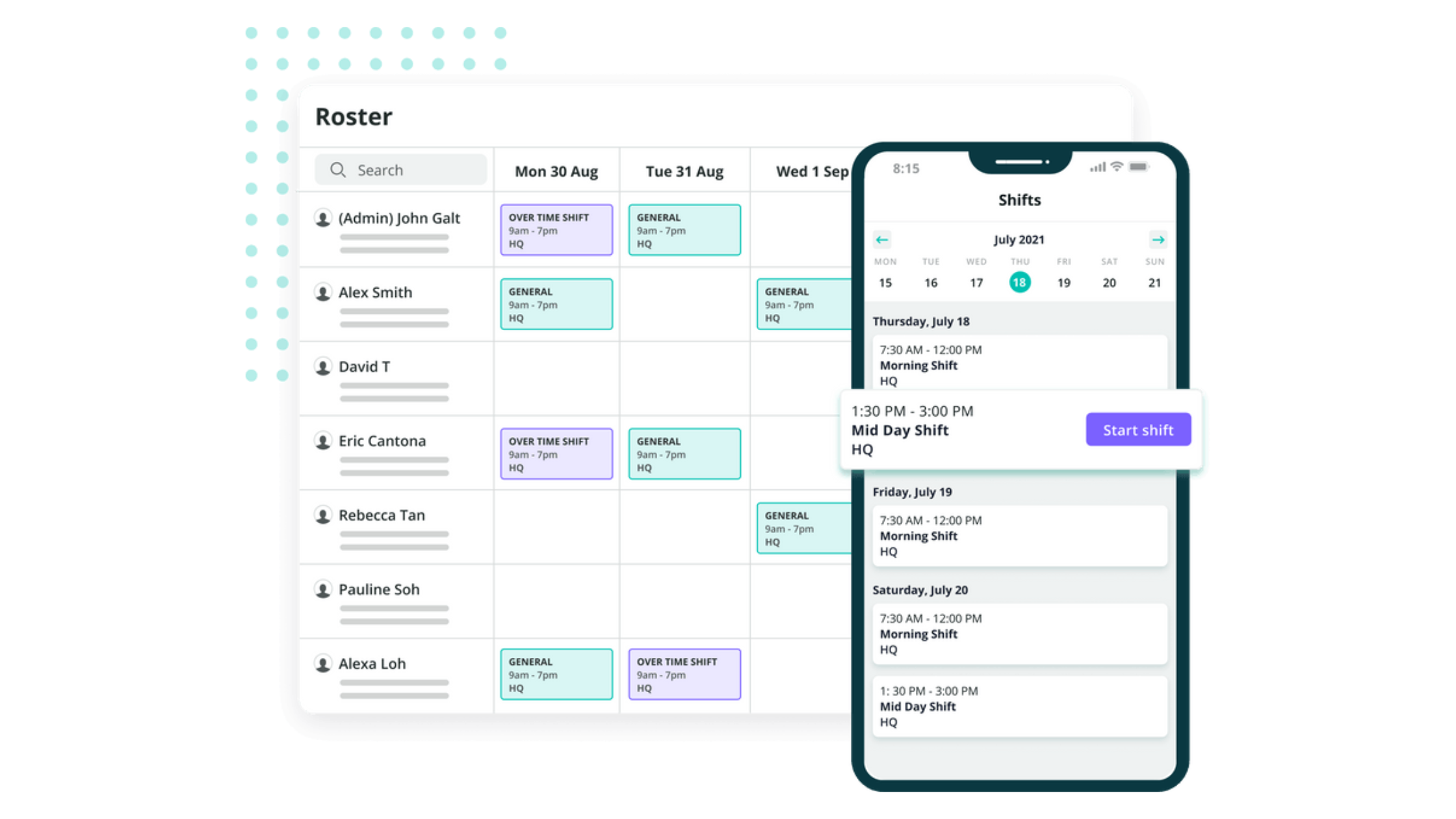

1. Employee Scheduling & Shift Management

- Flexible Scheduling: Allows managers to create, adjust, and view schedules with ease, ensuring that shifts are fully staffed according to peak hours and staff availability.

- Shift Swaps and Approvals: Employees can request shift swaps or changes directly through the app, which managers can approve with a single click. This reduces the administrative burden and ensures accurate tracking of worked hours.

- Automated Reminders: Sends out shift reminders to employees, minimizing no-shows and late arrivals. This helps align scheduling data with payroll calculations and improves operational efficiency.

2. Attendance Tracking

- Real-Time Tracking: Records employee clock-ins and clock-outs in real-time, ensuring accurate timekeeping for calculating payroll. This reduces discrepancies between actual worked hours and reported hours.

- Geofencing: Verifies that employees are clocking in from the appropriate restaurant location. This feature helps to prevent time theft and ensures that payroll data reflects only legitimate, on-site work hours.

3. Task Management

- Task Assignment and Progress Tracking: Allows managers to assign specific tasks to employees and monitor their completion status. By linking task performance to payroll, it ensures accountability and helps measure productivity, which can be useful for incentive-based pay.

- Daily Checklists: The app includes checklists that employees must complete, creating a clear record of completed work. These records can help validate payroll adjustments and support performance reviews.

Also Read: Top 10 Restaurant Task Management software for 2025

4. Training & Compliance

- Learning Management System (LMS): Offers built-in training modules that ensure employees remain compliant with industry standards and regulations. This reduces the likelihood of payroll-related errors due to non-compliance issues, which can impact labor costs.

- Certification Tracking: Tracks employee certifications and training completions, ensuring employees are up-to-date with required skills and training. This is particularly valuable for payroll adjustments tied to certifications or skill-based pay increases.

5. Labor Cost Insights & Payroll Integration

- Labor Cost Analysis: Provides real-time insights into labor costs, which can help managers make informed staffing decisions. Managers can optimize staffing and improve payroll efficiency by analyzing costs and correlating them with sales and revenue data.

- Seamless Payroll Integration: The KNOW App integrates smoothly with popular payroll systems, simplifying data transfers. This integration automates payroll calculations based on hours worked, overtime, and other factors, ensuring that payroll processing is accurate and efficient.

Explore KNOW!

Frequently Asked Questions (FAQs)

1. What is Restaurant Payroll Software?

Restaurant payroll software is a tool specifically created to handle automated payroll processing processes within the restaurant industry. The restaurant payroll services automate the payroll process with calculations for cash tips, tax deductions, and withholdings.

It also accommodates unique aspects of the restaurant industry labor, including tipped wages, overtime for fluctuating shifts, and varying pay rates. This software integrates with time-tracking and scheduling tools, facilitating accurate payments and compliance management with labor laws specific to the restaurant industry.

2. How Does Payroll Software Handle Compliance?

Payroll software assists in maximizing employee retention, and maintaining tax compliance by automatically updating federal, state, and local tax rates & labor law regulations. This system oversees minimum wage adjustments, overtime regulations, and tip credit calculations to assist restaurants in adhering to minimum wage requirements, and hour laws.

It also produces compliance reports, including employee tax forms, and tracks employee work hours to avoid breaches of labor and tax laws together.

3. Why is Integration with Scheduling Software Important?

It connects employee schedules with payroll, ensuring that hours worked are accurately reflected in payroll calculations. This integration minimizes errors, enhances on-time efficiency, and supports precise overtime calculations.

Syncing schedules with payroll allows managers to effectively monitor labor costs, avoid scheduling conflicts, and ensure compliance with regulations. This practice ultimately enhances efficiency and financial management.

4. How Does KNOW Work as Suitable Payroll Software?

The KNOW App enhances payroll software for restaurants by improving time-tracking, scheduling, and compliance management for payroll software designed specifically for restaurants. It provides real-time attendance tracking through geofencing, making the time periods and attendance data for payroll easier to handle.

KNOW’s shift scheduling feature is designed to align employee scheduling with payroll rules. Additionally, its task management and labor cost analytics tools offer insights that can help optimize workforce management and payroll expenses. KNOW integrates with existing payroll systems to streamline operations and ensure accurate, compliant payroll processing tailored to the needs of restaurants.

Implementing the right payroll restaurant software can revolutionize your restaurant operations. By automating and streamlining payroll processes, you can achieve greater accuracy, ensure compliance, and free your team to focus on strategic initiatives that drive growth. Choosing software tailored to your unique business needs is crucial for maximizing efficiency and effectiveness.

The KNOW platform delivers a robust suite of payroll, HR, and workforce management solutions specifically designed to address the payroll challenges faced by restaurants. Whether you require payroll software, integration solutions, or comprehensive support, KNOW is your partner in optimizing your HR and payroll processes for lasting success.

Get Started with KNOW and discover how easy payroll can while enhancing your restaurant business through effective payroll restaurant software.

![The 10 Best Restaurant Scheduling Software and Apps [2025] restaurant scheduling software](https://www.getknowapp.com/blog/wp-content/uploads/2024/09/restaurant-scheduling-software-360x240.png)