You want your restaurant operations to run efficiently while maintaining your financial health. How do you make that possible? You focus on your restaurant labor cost percentage! This blog will cover everything you need to learn about calculating labor costs and ensuring it works wonders for your restaurant business. Read on!

What is of Labor Cost Percentage?

Your restaurant labor cost percentage represents how much you spend on your employee’s wages and salaries against the amount you generate as your sales.

Remember – Your restaurant labor cost is not only about regular salaries and hourly wages. It’s more than that!

Labor costs also include:

- Overtime pay

- Bonuses

- Paid time off

- Taxes on payroll

- Healthcare benefits

- Equipment costsWe will cover more on this later.

Why calculating labor cost percentage is important?

Your labor cost is, certainly, one of the most expensive costs you incur. It’s important to keep a tab on this metric. Here’s why:

1. Impacts your profitability

Your labor costs are a fixed amount that you spend on your staff. There are two ways to see how the labor cost percentage can affect your profitability. When the cost percentage is high, your profit margin might decrease. When you spend too much on staff, most of your profit goes into salaries.

On the other hand, if you keep your labor costs too low, there might be chances that you hire poor talent who provide low-quality service and hamper your restaurant’s reputation. This will, ultimately, lead to lower profit margins.

What is the moral of the story? Strike a good balance between how much you want to spend on labor and what is the ideal profit you are looking at. Once you have clarity on this, you are prepared to move up the profit ladder and maintain a good labor cost percentage.

Make sure you work on attracting talent who can deliver great service at a reasonable compensation bracket. You might have a small workforce, but you always have the power to turn it into a mighty workforce. Spending less on labor doesn’t always have to mean that the service quality will be unsatisfactory.

2. Enables effective cash flow management

When you know your labor cost percentage, it helps you identify if your menu pricing needs to be revised or not. For instance, if you observe that your labor cost percentage is way too high, you might want to increase your food prices to cover up for the missed revenue and optimize your cash receipts.

3. Helps assess standard payroll rates in the market and adjust yours accordingly

With labor cost percentage, you get to identify if you’re spending a fair amount on your payroll operations. Wondering how? Let’s say you performed a thorough competitor analysis and learned that the average labor cost percentage in the market is 30% while yours is 38%. What will you do? You will figure out ways to reduce your labor cost percentage to normal. You don’t want your competition to drive greater revenue than you.

What should be the average labor cost percentage for restaurants?

Are you wondering what the ideal percentage of your labor cost should be? We’ve got the right answer for you! It’s recommended to keep your restaurant labor cost percentage below 30%. However, you don’t need to stick to this number. There are different restaurant types and there are chances your restaurant type has a different average labor cost percentage.

Average labor cost percentage by restaurant types:

- Casual dining: 25% – 30%

- Fine dining restaurants: 30%-35%

- Bars: 18% – 24%

- Quick service restaurants: 25% – 30%

- Table service restaurants: 30% – 40%

Are you wondering why the restaurant labor cost varies for different restaurant types? Well, the answer is simple! They all have different workforce sizes. The size of your company will help decide what your restaurant’s labor cost should be.

For example: Quick service restaurants will have a lower labor cost percentage than full service restaurants. This is because they don’t need many staff members to run the restaurant operations.

On the other hand, a fine-dining restaurant will have comparatively higher labor costs as it has many staff members like servers, chefs, specialized cooks for different types of cuisine, and more.

Components of Restaurant Labor Costs

As discussed earlier, your restaurant labor costs include more than your employee salary and minimum wage. It comprises many other elements. Let’s go over them one by one:

A. Wages and Salaries: Wages and salaries are considered to be the primary labor costs. Base salaries are the regular, fixed amount paid to the employees over a given period of time. Hourly wage depends on the number of hours of service that the employee has completed.

B. Payroll Taxes: This includes two components: one payroll is the amount paid by the employer to the employee for his/her service. The other is the payroll taxes. You and your employees pay this amount.

C. Overtime pay: This is one of the types of restaurant labor costs where you pay some additional amount to employees who work overtime. This labor cost usually has a higher rate and should be kept in check to reduce the restaurant labor cost percentage.

D. Paid time off: This labor cost will include the compensation you provide employees for vacation, sick days, and other PTO.

E. Healthcare: This is a common labor cost incurred when you provide several health benefits to your staff members. It includes dental care, vision care, and others.

F. Bonuses: Bonus is a labor cost you pay as an additional amount to employees for their good performance and achieving certain targets and goals.

Factors to consider before calculating labor cost percentages

1. Decide the time duration

Now, when you decide to calculate your labor costs, you should have a defined time duration in your mind. You have to decide what time you want to consider – do you want to measure your restaurant’s labor cost percentage for a month, one quarter, or on an annual basis?

2. Know your total labor costs

In order to calculate restaurant labor costs, it is important that you know the exact figures of your total labor costs. You will have to collect information on all the employee-related expenses like wages and salaries, overtime pay, bonuses, healthcare schemes, paid time off, and payroll taxes. Also, make sure that you are gathering this data for a set period of time like a month, quarter, or year. It should be the same period for all types of labor costs.

3. Identify your total sales

Another requirement for calculating your labor cost percentages is to produce your sales report. The report should include your gross sales for the decided time to calculate your restaurant labor cost percentage.

How to Calculate Restaurant Labor Cost Percentage?

Calculating your restaurant labor costs percentage doesn’t have to be daunting! We got you the secret recipe for calculating labor cost percentages. But before we look at the best methods to calculate labor cost as a percentage, we will go over some of the essential points you need to have ready with you.

3 best methods to calculate restaurant labor cost percentage

In this section, we will look at the three best techniques to measure labor cost as a percentage. One is the labor as a percentage of sales, the other is as a percentage of total operating costs, and the last one is as per the number of hours worked.

Method 1: Labor as a percentage of sales

This is considered the most common method to calculate labor costs in the restaurant industry. To help you understand better, we will consider one year as the time period.

A quick breakdown of calculating labor cost as a percentage of sales:

Step #1: Figure out your restaurant’s labor costs. Meaning? What was the total amount paid to your staff members throughout one year?

Step #2: Calculate your restaurant’s revenue! Now, your revenue will be the amount earned before deductions like tax.

Step #3: You divide your restaurant’s labor cost by your annual revenue.

Step #4: Multiply the amount attained in step #3 by 100 and you will know your restaurant’s labor cost as a percentage of sales.

Hypothetical scenario to calculate labor costs as a percentage of sales

You want to learn about your restaurant’s labor cost percentage for the year 2023. You start with collecting labor costs for the entire year. Let’s say the total is $300k. Then you produce your sales report for 2023. It reflects your total revenue as $1000k.

Formula: (Total labor cost / Total Revenue) x 100

(300/1000) x 100 = 30

This means that your restaurant’s labor cost percentage is 30%. It is the average percentage to have in the restaurant industry.

Method 2: Labor costs as a percentage of total operating costs

Below are the steps for calculating labor cost percentage by the total operating costs method:

Step #1: Figure out your restaurant’s labor costs – the total amount paid to your staff members throughout one year.

Step #2: Calculate your restaurant’s total operating costs. Your operating costs will include all the transactions related to your business – sales, money spent on marketing, preparing food & beverages, restaurant rent, and others.

Step #3: Divide your total labor costs by the total operating costs.

Step #4: Multiply the amount attained in step #3 by 100 to get your labor costs as a percentage of total operating costs.

Total operating costs method formula:

(Total labor costs / Total operating costs) x 100

Apart from these two methods, there’s one more popular method that you could use to calculate your labor cost percentage.

Method 3: Calculating labor costs by the number of hours worked

Your restaurant workforce comprises chefs, servers, bartenders, and more. In this method, you calculate the labor costs per hour for all your employee groups. Let’s try to understand this with the help of an example:

You have three staff members from the cleaning group. They work for 30 hours every week and you pay them $18 per hour for their service. How will you find out the average cost per hour for a year?

Simple.

Formula: Average cost per hour of service = (Weekly service hours by the cleaning department x Average hourly wage) / 52 weeks in a year

(90 x $1620) / 52 = $31.15

$31.15 is your labor costs according to the number of hours worked method.

Strategies to Optimize Labor Cost Percentage

Higher labor costs are not good for your restaurant’s overall profit. Here are some tips that will help you lower labor costs and stay a top player in the restaurant industry:

1. Split employee shifts

Splitting shifts is one of the best tips to lower labor costs. All you need is to break your employee’s shift into two shifts. The break in between will be unpaid. Are you wondering how to split shifts the right way?

Easy! Identify the busiest hours in your restaurant. Also, check which hours are the quietest. Your staff members could come during the busy hours and then take paid time off. They could come again during rush hours.

2. Limit the number of overtime hours

Overtime payments can increase your total labor costs and hurt your pockets. When you design the work schedule for staff members, divide the tasks equally. This way, you won’t require anyone to work extra hours to complete any job.

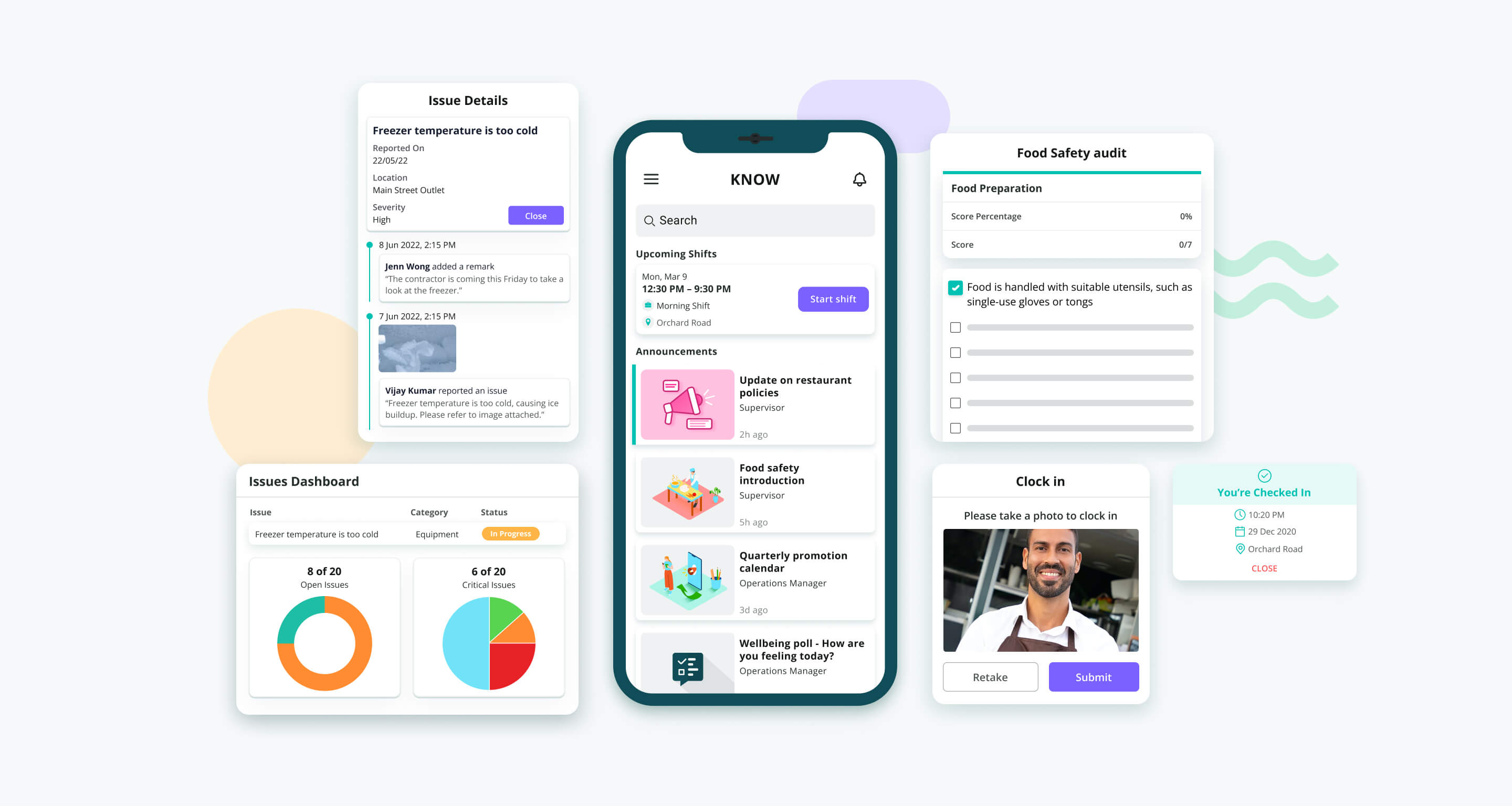

You could use the KNOW app to avoid the staff scheduling chaos. Our solution enables you to send notifications to your employees about their shifts on their mobile phones. You could also send automated reminders on shift timings, last-minute changes, etc.

3. Focus on employee retention

Staff turnover is one of the main reasons for higher labor cost percentages for restaurant owners. Hiring and training news resources can prove to be too costly. Make sure your staff members are happy with your work culture and the salaries they receive. Engage with them regularly and talk about their concerns, if any.

4. Cross-train employees

Aim to do more in less! Cross-training is one of the best ways restaurant owners can facilitate reduced labor costs. Keep conducting training sessions for your staff members. They should have a fair idea of what their colleague does, and what all are their roles and responsibilities. This way, your staff members can perform each other tasks when any of them goes for some paid time off, holidays, etc,.

5. Use modern restaurant software & tools

Using modern restaurant software helps you automate your complex restaurant operations like staff scheduling, compliance management, employee onboarding, communication, payroll, and more.

Get Smarter with KNOW

We automate your major tasks. We save time. We enable day-to-day seamless operations. KNOW is trusted by 1,000,000+ users and leading restaurants across the globe. Manage digital log books, checklists, and reports – with just one click retrieval.

The best part? Our app’s design is simple. It is accessible to all ages, countries, skill levels, and tech capabilities, and supports all major languages. Get started in just minutes – Connect now.

FAQ

1. What percentage should labor cost be?

It’s recommended to keep your restaurant labor cost percentage below 30%. However, you don’t need to stick to this number. There are different restaurant types and there are chances your restaurant type has a different average labor cost percentage.

2. What is labor costs percentage?

It represents how much you spend on your employee’s wages and salaries against the amount you generate as your sales.

3. How to calculate labor costs?

There are three best techniques to measure labor cost as a percentage. One is the labor as a percentage of sales, the other is as a percentage of total operating costs, and the last one is as per the number of hours worked.

4. Which is the best restaurant software to use?

KNOW is trusted by 1,000,000+ users and leading restaurants across the globe. Manage digital log books, checklists, and reports – with just one click retrieval.

The best part? Our app’s design is simple. It is accessible to all ages, countries, skill levels, and tech capabilities, and supports all major languages.